Multiple Choice

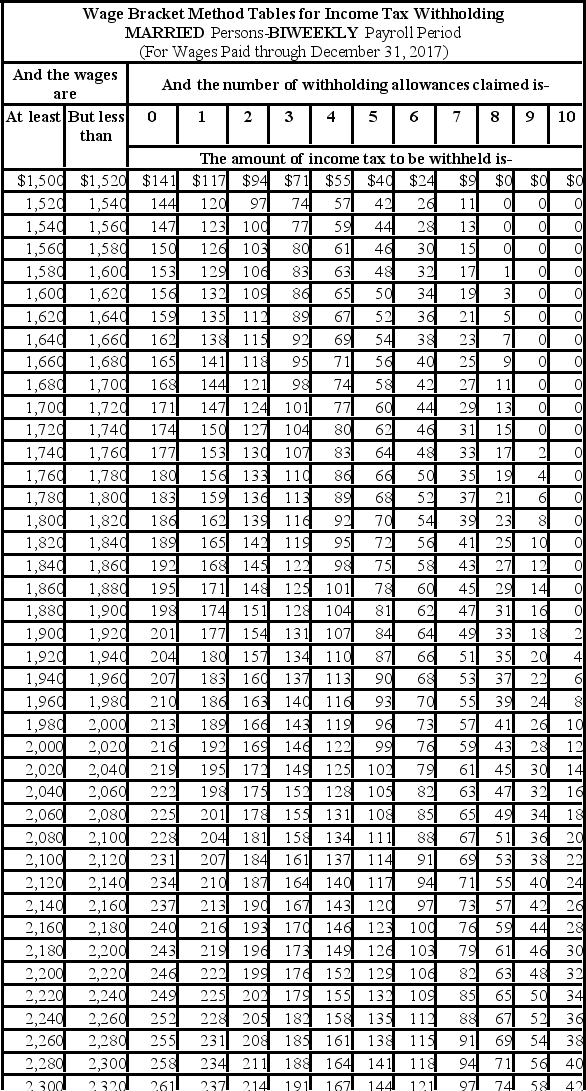

Ramani earned $1,698.50 during the most recent biweekly pay period. He contributes $100 to his 401(k) plan. He is married and claims 3 withholding allowances. Based on the following table, how much Federal income tax should be withheld from his pay?

A) $124.00

B) $101.00

C) $98.00

D) $83.00

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Which of the following federal withholding allowance

Q10: Charitable contributions are an example of post-tax

Q19: Which body issued Regulation E to protect

Q21: What is a disadvantage to using paycards

Q36: A firm has headquarters in Indiana,but has

Q43: Disposable income is defined as:<br>A)An employee's net

Q60: Which of the following is used in

Q60: The factors that determine an employee's federal

Q63: Vivienne is a full-time exempt employee in

Q65: Steve is a full-time exempt employee at