Multiple Choice

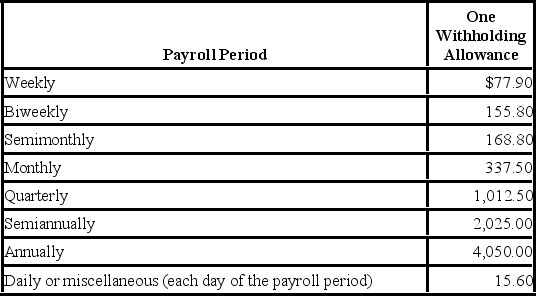

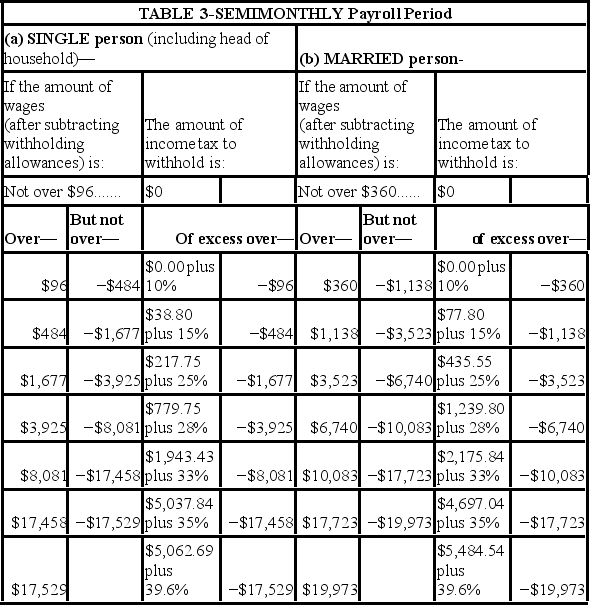

Danny is a full-time exempt employee in Alabama, where the state income tax rate is 5%. He earns $78,650 annually and is paid semimonthly. He is married with four withholding allowances. His is health insurance is $100.00 per pay period and is deducted on a pre-tax basis. Danny contributes 5% of his pay to his 401(k) . Assuming that he has no other deductions, what is Danny's net pay for the period? (Use the percentage method for the federal income tax and the wage-bracket table for the state income tax. Do not round interim calculations, only round final answer to two decimal points.) Table 5. Percentage Method-2017 Amount for one Withholding Allowance

A) $2,245.53

B) $2,403.95

C) $2,361.72

D) $2,178.90

Correct Answer:

Verified

Correct Answer:

Verified

Q4: The percentage of the Medicare tax withholding

Q10: Charitable contributions are an example of post-tax

Q14: The percentage method of determining an employee's

Q19: Which body issued Regulation E to protect

Q21: The amount of federal income tax decreases

Q33: What is an advantage of direct deposit

Q43: Disposable income is defined as:<br>A)An employee's net

Q53: Natalia is a full-time exempt employee who

Q60: The factors that determine an employee's federal

Q60: Which of the following is used in