Multiple Choice

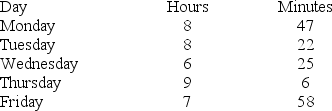

Libby is an hourly employee who earns $14.32/hour. She is paid overtime only for hours worked past 40 in one week. During a weekly pay period, she worked the following hours:  What is the difference between her pay using the quarter-hour and the hundredth-hour methods? Which method pays Libby the greater amount? (Do not round interim calculations. Round final answer to two decimal places.)

What is the difference between her pay using the quarter-hour and the hundredth-hour methods? Which method pays Libby the greater amount? (Do not round interim calculations. Round final answer to two decimal places.)

A) $1.07; Quarter-hour

B) $1.07; Hundredth-hour

C) $2.86; Quarter-hour

D) $2.86; Hundredth-hour

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Compensatory time is only federally mandated for

Q6: Bruce is a nonexempt employee at Grissom

Q8: Phillippe is an inside salesperson who earns

Q10: Cyrus is a tipped employee in Illinois.

Q13: Diane is a salaried, nonexempt worker with

Q14: A nonexempt, salaried worker who received $46,500

Q21: Piece-rate pay is used for employees who

Q23: Gross pay is the amount of employee

Q48: Which of the following items would not

Q71: Which of the following is always true