Multiple Choice

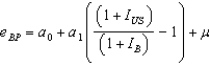

The following regression analysis was conducted for the inflation rate information and exchange rate of the British pound:  Regression results indicate that a0 = 0 and a1 = 1. Therefore:

Regression results indicate that a0 = 0 and a1 = 1. Therefore:

A) purchasing power parity holds.

B) purchasing power parity overestimated the exchange rate change during the period under examination.

C) purchasing power parity underestimated the exchange rate change during the period under examination.

D) purchasing power parity will overestimate the exchange rate change of the British pound in the future.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: If interest rate parity holds, then the

Q9: According to the IFE, when the nominal

Q10: The nominal interest rate can be measured

Q11: According to the international Fisher effect, if

Q12: Which of the following is not true

Q14: Interest rate parity can only hold if

Q15: If interest rate parity holds, and the

Q16: Which of the following theories can be

Q17: According to purchasing power parity (PPP), if

Q18: If interest rate parity holds, then the