Multiple Choice

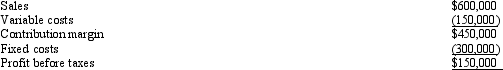

Shelton Company Below is an income statement for Shelton Company: Refer to Shelton Company. Based on the cost and revenue structure on the income statement, what was Shelton's break-even point in dollars?

Refer to Shelton Company. Based on the cost and revenue structure on the income statement, what was Shelton's break-even point in dollars?

A) $300,000

B) $400,000

C) $425,000

D) $450,000

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Total fixed costs remain unchanged with levels

Q13: Contribution margin divided by revenue is referred

Q16: To compute the break-even point in units,which

Q24: Which of the following factors is involved

Q26: On a CVP graph,the total cost line

Q88: Pratt Corporation<br>Information relating to the current operations

Q89: Sunglo Corporation Sunglo Corporation manufactures and sells

Q94: Price Corporation<br>Price Corporation manufactures and sells two

Q98: Fixed costs per unit remain constant with

Q98: The following information pertains to Mercury Company's