Multiple Choice

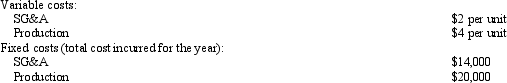

Oakwood Corporation Oakwood Corporation produces a single product. The following cost structure applied to its first year of operations: Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation produced 5,000 units and sold 4,500 units in the current year. If Oakwood uses absorption costing, it would deduct period costs of

Refer to Oakwood Corporation. Assume for this question only that Oakwood Corporation produced 5,000 units and sold 4,500 units in the current year. If Oakwood uses absorption costing, it would deduct period costs of

A) $24,000.

B) $34,000.

C) $27,000.

D) $23,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Absorption costing is commonly used for external

Q64: A credit to the Factory Overhead account

Q94: What are the major differences between variable

Q156: Bush Corporation The following information has been

Q157: Anderson Corporation Anderson Corporation has the following

Q157: In a actual cost system,factory overhead is

Q164: If actual overhead is less than applied

Q170: Overapplied overhead will result if<br>A)the plant is

Q182: Consider the following three product costing alternatives:

Q196: When using the high-low method,the variable component