Multiple Choice

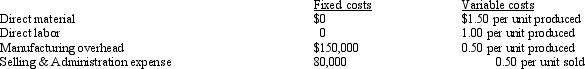

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. In presenting inventory on the balance sheet at December 31, the unit cost under absorption costing is

A) $2.50.

B) $3.00.

C) $3.50.

D) $4.50.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Normal capacity considers present and future production

Q25: Another name for variable costing is<br>A)full costing.<br>B)direct

Q34: Oakwood Corporation Oakwood Corporation produces a single

Q35: Davis Corporation has the following data relating

Q41: Denver Corporation The records of Denver Corporation

Q55: Phantom profits result when absorption costing is

Q93: An ending inventory valuation on an absorption

Q95: Profit under absorption costing may differ from

Q151: In an income statement prepared as an

Q189: How can a company produce both variable