Multiple Choice

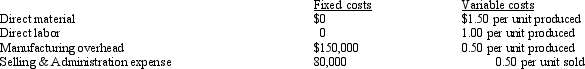

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit. Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year. Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs. Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation. What is the net income under variable costing?

A) $50,000

B) $80,000

C) $90,000

D) $120,000

Correct Answer:

Verified

Correct Answer:

Verified

Q18: What are the primary reasons for using

Q21: A short-run measure of activity that represents

Q25: Since overhead costs are indirect costs,<br>A)they require

Q62: Sales minus cost of goods sold is

Q81: If production exceeds sales,absorption costing net income

Q91: If underapplied factory overhead is immaterial,the account

Q126: The costing system that classifies costs by

Q127: If a firm uses absorption costing,fixed manufacturing

Q157: Under variable costing,which of the following are

Q191: Denver Corporation The records of Denver Corporation