Essay

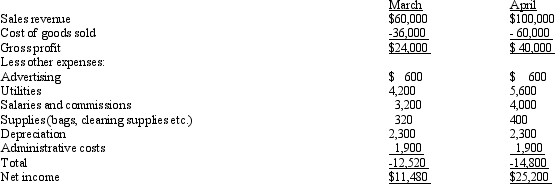

McFatter Office Supply Company has the following information available regarding costs and revenues for two recent months. Selling price is $20.

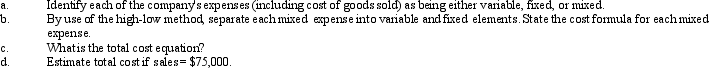

Required:

Required:

Correct Answer:

Verified

FC = $4,200 - (3.5% ´ 60,000...

FC = $4,200 - (3.5% ´ 60,000...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: What are three reasons that overhead must

Q48: If underapplied or overapplied factory overhead is

Q70: On the variable costing income statement,the difference

Q101: Sheets Corporation The following information was extracted

Q105: Anderson Corporation Anderson Corporation has the following

Q124: Variable costing is commonly used for external

Q146: If overapplied factory overhead is material,the account

Q147: Under absorption costing,if sales remain constant from

Q150: The FASB requires which of the following

Q197: If actual overhead exceeds applied overhead,factory overhead