Multiple Choice

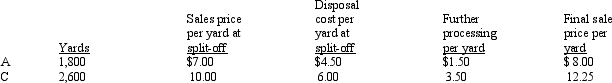

Johnson Company Ellis Company produces two products from a joint process: A and C. Joint processing costs for this production cycle are $9,000. If A and C are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

If A and C are processed further, no disposal costs will be incurred or such costs will be borne by the buyer.

Refer to Johnson Company. Using approximated net realizable value at split-off, what amount of joint processing cost is allocated to Product A (round to the nearest dollar) ?

A) $2,718

B) $2,934

C) $3,014

D) $4,500

Correct Answer:

Verified

Correct Answer:

Verified

Q10: Allocating joint costs based upon a physical

Q18: Joint cost allocation is useful for<br>A)decision making.<br>B)product

Q19: For purposes of allocating joint costs to

Q74: Monetary allocation measures recognize the revenue generating

Q82: If a company obtains two salable products

Q97: Davis Company Davis Company produces three products:

Q98: Johnson Company Ellis Company produces two products

Q99: Ellis Company Ellis Company produces two products

Q100: Brite Surface Company Brite Surface Company produces

Q103: Joint costs include all materials,labor and overhead