Multiple Choice

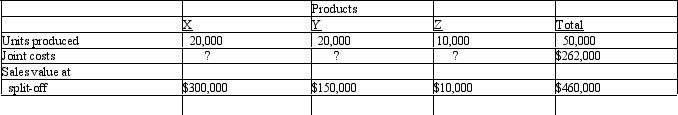

Kellman Company Kellman Company manufactures products X and Y from a joint process that also yields a by-product, Z. Revenue from sales of Z is treated as a reduction of joint costs. Additional information is as follows: Joint costs were allocated using the sales value at split-off approach.

Joint costs were allocated using the sales value at split-off approach.

Refer to Kellman Company. The joint costs allocated to product Y were

A) $ 84,000

B) $100,800.

C) $150,000.

D) $168,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q14: Waste created by a production process is<br>A)accounted

Q21: A decision that must be made at

Q52: Net realizable value equals product sales revenue

Q96: Which of the following is a commonly

Q105: The net realizable value approach is used

Q115: Johnson Company Ellis Company produces two products

Q118: Davis Company Davis Company produces three products:

Q122: Kelly Company Kelly Company is placing an

Q123: Skinner Company produced three joint products at

Q124: Melbourne Company Melbourne Company manufactures three products