Essay

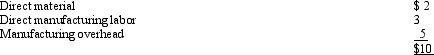

Travers Corporation is working at full production capacity producing 10,000 units of a unique product, RST. Manufacturing costs per unit for RST follow:

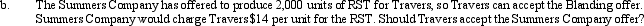

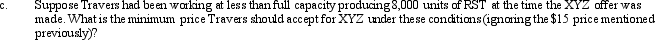

The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The non-manufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, Blanding Company, has asked Travers to produce 2,000 units of a modification of RST to be called XYZ. XYZ would require the same manufacturing processes as RST. Blanding Company has offered to share equally the non-manufacturing costs with Travers. XYZ will sell at $15 per unit.

The unit manufacturing overhead cost is based on a variable cost per unit of $2 and fixed costs of $30,000 (at full capacity of 10,000 units). The non-manufacturing costs, all variable, are $4 per unit, and the selling price is $20 per unit. A customer, Blanding Company, has asked Travers to produce 2,000 units of a modification of RST to be called XYZ. XYZ would require the same manufacturing processes as RST. Blanding Company has offered to share equally the non-manufacturing costs with Travers. XYZ will sell at $15 per unit.

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In a special order decision,unavoidable current fixed

Q35: For a particular product in high demand,a

Q41: The management of Hepner Industries has been

Q41: In linear programming,a limiting factor that hampers

Q51: Galveston Pipe Corporation The capital budgeting committee

Q52: The benefits foregone when one course of

Q63: An increase in direct fixed costs could

Q129: In a linear programming problem,constraints are indicated

Q135: The feasible region for a graphical solution

Q136: Maximization of contribution margin is a common