Essay

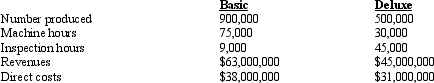

Office Innovations Corporation produces two types of electronic data organizers: basic and deluxe. The following information about the production process is available:

Total factory overhead is $10,000,000. Of this overhead, $4,000,000 is related to utilities and the remainder is related to quality control.

Total factory overhead is $10,000,000. Of this overhead, $4,000,000 is related to utilities and the remainder is related to quality control.

a. Determine the total overhead cost assigned to each type of data organizer using machine hours as the allocation base. Calculate the gross profit per unit for each product.

b. Determine the total overhead cost assigned to each type of data organizer if overhead is assigned using allocation bases appropriate to the overhead costs. Calculate the gross profit per unit of each product.

c. Explain why the unit cost for each model is different between the two methods of allocation.

Correct Answer:

Verified

c) When machine hours are used to alloc...

c) When machine hours are used to alloc...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: A process map<br>A)should indicate only value-added activities.<br>B)is

Q44: Activity analysis allows managers to<br>A)classify activities so

Q45: The sum of value-added processing time plus

Q106: Lead time in a production process includes

Q135: Building depreciation is generally considered a product

Q148: A series of activities that when performed

Q158: Video Corporation Video Corporation has two product

Q161: Ada National Bank Ada National Bank had

Q163: The following items are used in tracing

Q167: Implementing activity based costing (ABC)has a direct