Essay

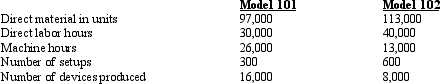

Seattle Grace Corporation manufactures two models of a medical device: Model 101 and Model 102.

Below is the current year production data for the company:

The 210,000 units of material had a total cost of $1,365,000. Direct labor is $17 per hour.

The 210,000 units of material had a total cost of $1,365,000. Direct labor is $17 per hour.

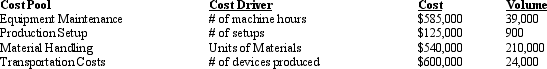

The company has total overhead production costs of $1,850,000.

a. If Seattle Grace Corporation applies factory overhead using direct labor hours, compute the total production cost and the unit cost for each model

b. If Seattle Grace Corporation applies factory overhead using machine hours, compute the total production cost and the unit cost for each model.

c. Assume that Seattle Grace Corporation has established the following activity centers, costs drivers, and costs to apply factory overhead.

Compute the total cost and the unit cost for each model.

Compute the total cost and the unit cost for each model.

d. Explain why the unit cost for each model is different across the three methods of overhead application. How can such information benefit an organization?

Correct Answer:

Verified

d. The allocation of overhead using vol...

d. The allocation of overhead using vol...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Costs that are common to many different

Q76: Mass customization can be achieved through the

Q93: Video Corporation Video Corporation has two product

Q94: Ada National Bank Ada National Bank had

Q96: For a CPA firm, how would the

Q97: Levine Company Levine Company produces two products:

Q99: Ada National Bank Ada National Bank had

Q101: Video Corporation Video Corporation has two product

Q102: For a company that manufactures candy, how

Q105: In activity-based costing,how are cost drivers selected?