Essay

Carter, Inc. produces two different products, Product A and Product

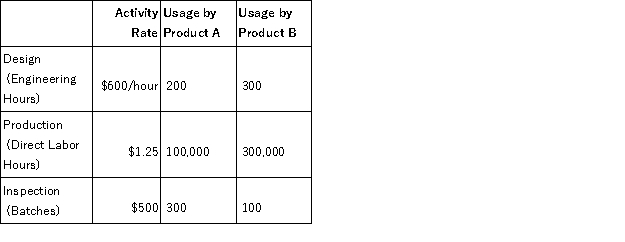

B. Carter uses a traditional volume-based costing system in which direct labor hours are the allocation base. Carter is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,000,000 across three activities: Design, Production, and Inspection. Under the traditional volume-based costing system, the predetermined overhead rate is $2.50/direct labor hour. Under the ABC system, the rate for each activity and usage of the activity drivers are as follows:

Required:

Required:

a. Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b. Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system

c. Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d. Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e. Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Correct Answer:

Verified

a. $250,000 = $2.50 × 100,000

b. $750,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. $750,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The cost of quality training is an

Q6: The gross margin is calculated by subtracting

Q12: The purpose of Stage 1 allocations is

Q35: Cottonwood,Inc.produces two different products (Standard and Luxury)using

Q41: Each individual indirect cost should be assigned

Q58: Monroe,Inc.randomly selects ten units from each production

Q79: Managers who use activity-based management should begin

Q80: Hadley,Inc.manufactures a product that uses $15 in

Q86: An activity that is performed to benefit

Q99: Under activity based management,cost management is achieved