Essay

Hayden, Inc. produces two different products, Product A and Product

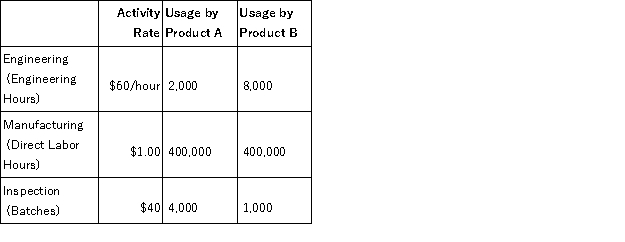

B. Hayden uses a traditional volume-based costing system in which direct labor hours are the allocation base. Hayden is considering switching to an ABC system by splitting its manufacturing overhead cost of $1,600,000 across three activities: Engineering, Manufacturing, and Inspection. Under the traditional volume-based costing system, the predetermined overhead rate is $2.00/direct labor hour. Under the ABC system, the rate for each activity and usage of the activity drivers are as follows:

Required:

Required:

a. Calculate the indirect manufacturing costs assigned to Product A under the traditional costing system.

b. Calculate the indirect manufacturing costs assigned to Product B under the traditional costing system

c. Calculate the indirect manufacturing costs assigned to Product A under the ABC system.

d. Calculate the indirect manufacturing costs assigned to Product B under the ABC system.

e. Which product is under-costed and which is over-costed under the volume-based cost system compared to ABC?

Correct Answer:

Verified

a. $800,000 = $2.00 × 400,000

b. $800,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b. $800,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Target costing involves determining what the product

Q4: Harwell, Inc. uses a traditional volume-based costing

Q8: Chipman Inc. produces water pumps. Overhead costs

Q10: Lynwood, Inc. produces two different products (Product

Q14: Carter, Inc. uses a traditional volume-based costing

Q38: Activity Based Costing divides activities into two

Q76: Internal failure costs result from defects that

Q77: An activity cost driver is:<br>A)a measure of

Q98: An activity that is performed for a

Q130: An activity that is performed for a