Multiple Choice

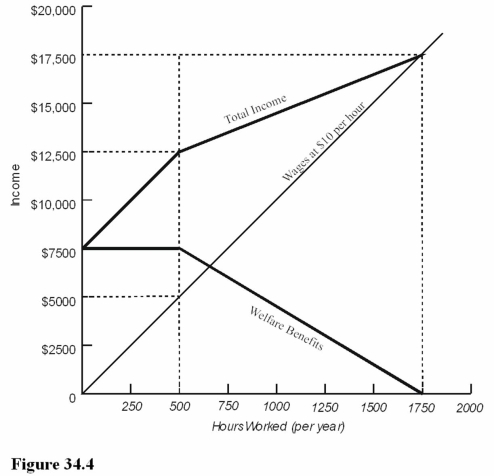

-Refer to Figure 34.4.The implied marginal tax rate in this example is

A) 0 percent.

B) Between 0 and 100 percent.

C) 100 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: A goal of income transfer programs is

Q25: Lower marginal tax rates for welfare programs

Q28: Suppose a poverty program has a basic

Q29: Social Security benefits paid by the federal

Q32: If welfare benefits equal the poverty gap

Q33: In 2011,the largest U.S.in-kind transfer program was<br>A)Medicare.<br>B)Food

Q34: The Social Security program is financed by<br>A)Corporate

Q63: The existence of income transfer programs can<br>A)Increase

Q69: The breakeven level of income equals the<br>A)Minimum

Q113: A transfer program that is event-triggered for