Multiple Choice

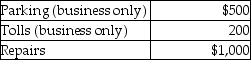

Chelsea,who is self-employed,drove her automobile a total of 20,000 business miles in 2016.This represents about 75% of the auto's use.She has receipts as follows:  Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method.After application of any relevant floors or other limitations,she can deduct

Chelsea has an AGI for the year of $50,000.Chelsea uses the standard mileage rate method.After application of any relevant floors or other limitations,she can deduct

A) $11,500.

B) $12,200.

C) $10,800.

D) $11,325.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: An accountant takes her client to a

Q51: Which of the following statements regarding independent

Q63: A nondeductible floor of 2% of AGI

Q88: Gayle,a doctor with significant investments in the

Q115: In which of the following situations is

Q117: Jackson Corporation granted an incentive stock option

Q118: An employee has unreimbursed travel and business

Q123: Ellie,a CPA,incurred the following deductible education expenses

Q124: Tucker (age 52)and Elizabeth (age 48)are a

Q150: Travel expenses related to foreign conventions are