Multiple Choice

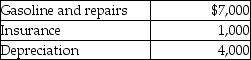

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use.The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

A) $1,500

B) $500

C) $1,000

D) $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Which of the following conditions would generally

Q24: Employees receiving nonqualified stock options recognize ordinary

Q45: Under a qualified pension plan,the employer's deduction

Q50: Clarissa is a very successful real estate

Q52: Which statement is correct regarding SIMPLE retirement

Q56: Transportation expenses incurred to travel from one

Q82: Which of the following statements regarding Health

Q89: Rui is a CPA is employed by

Q94: In a contributory defined contribution pension plan,all

Q373: A taxpayer goes out of town to