Multiple Choice

Austin incurs $3,600 for business meals while traveling for his employer,Tex,Inc.Austin is reimbursed in full by Tex pursuant to an accountable plan.What amounts can Austin and Tex deduct?

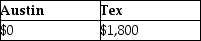

A)

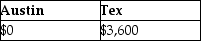

B)

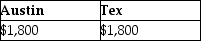

C)

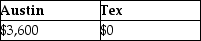

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q26: Tessa has planned a five-day trip to

Q39: Wilson Corporation granted an incentive stock option

Q42: Travel expenses for a taxpayer's spouse are

Q77: "Associated with" entertainment expenditures generally must occur

Q97: Matt is a sales representative for a

Q103: Donald takes a new job and moves

Q104: West's adjusted gross income was $90,000.During the

Q105: Tyne is a 48-year-old an unmarried taxpayer

Q110: H (age 50)and W (age 48)are married

Q131: When a public school system requires advanced