Multiple Choice

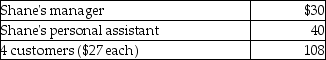

Shane,an employee,makes the following gifts,none of which are reimbursed:  What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

What amount of the gifts is deductible before application of the 2% of AGI floor for miscellaneous itemized deductions?

A) $125

B) $150

C) $75

D) $178

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q26: Tessa has planned a five-day trip to

Q42: Travel expenses for a taxpayer's spouse are

Q43: An accountant takes her client to a

Q77: "Associated with" entertainment expenditures generally must occur

Q88: Gayle,a doctor with significant investments in the

Q110: H (age 50)and W (age 48)are married

Q115: In which of the following situations is

Q117: Norman traveled to San Francisco for four

Q117: Jackson Corporation granted an incentive stock option

Q118: An employee has unreimbursed travel and business