Essay

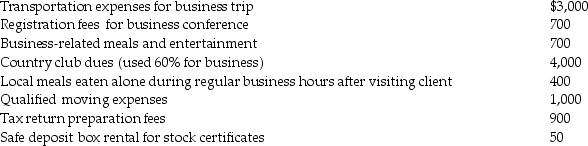

Rita,a single employee with AGI of $100,000 before consideration of the items below,incurred the following expenses during the year,all of which were unreimbursed unless otherwise indicated:

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

In addition,Rita paid $300 for dues to her professional business association.The company reimbursed her after she submitted the appropriate documentation for the dues.What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations?

Correct Answer:

Verified

The country club dues are not...

The country club dues are not...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Educational expenses incurred by a bookkeeper for

Q23: Josiah is a human resources manager of

Q26: In a defined contribution pension plan,fixed amounts

Q35: Explain when educational expenses are deductible for

Q38: Deductible moving expenses include the cost of

Q62: Which of the following situations will disqualify

Q103: Chuck, who is self- employed, is scheduled

Q147: Hannah is a 52-year-old an unmarried taxpayer

Q148: Generally,50% of the cost of business gifts

Q1609: Daniel has accepted a new job and