Multiple Choice

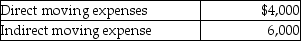

Edward incurs the following moving expenses:  The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

The employer reimburses Edward for the full $10,000.What is the amount to be reported as income by Edward?

A) $0

B) $4,000

C) $6,000

D) $10,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Personal travel expenses are deductible as miscellaneous

Q13: Tia is a 52-year-old an unmarried taxpayer

Q16: Tessa is a self-employed CPA whose 2016

Q19: David acquired an automobile for $30,000 for

Q21: Which of the following statements is incorrect

Q69: Corporations issuing incentive stock options receive a

Q72: If the standard mileage rate is used

Q82: Jason,who lives in New Jersey,owns several apartment

Q92: Which of the following statements regarding Coverdell

Q641: If an employee incurs travel expenditures and