Multiple Choice

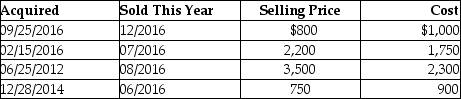

This year,Lauren sold several shares of stock held for investment.The following is a summary of her capital transactions for 2016:  What are the amounts of Lauren's capital gains (losses) for this year?

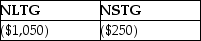

What are the amounts of Lauren's capital gains (losses) for this year?

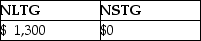

A)

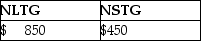

B)

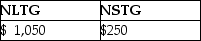

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q2: A taxpayer reports capital gains and losses

Q13: Rana purchases a 5%,$100,000 corporate bond at

Q15: The gain or loss on an asset

Q18: Darla sold an antique clock in 2016

Q37: Capital recoveries increase the adjusted basis of

Q47: Allison buys equipment and pays cash of

Q106: Courtney sells a cottage at the lake

Q107: Bad debt losses from nonbusiness debts are

Q127: If the shares of stock sold or

Q129: Emma Grace acquires three machines for $80,000,which