Multiple Choice

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year.After gains and losses are offset,Gertie reports

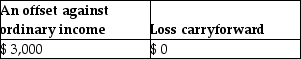

A)

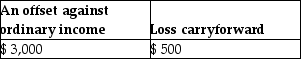

B)

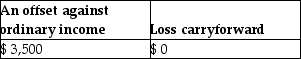

C)

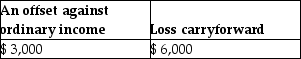

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Olivia,a single taxpayer,has AGI of $280,000 which

Q9: Which one of the following does not

Q16: Taxpayers who own mutual funds recognize their

Q20: Billy and Sue are married and live

Q35: If a nontaxable stock dividend is received

Q35: Stock purchased on December 15,2015,which becomes worthless

Q38: Sachi is single and has taxable income

Q39: Bev has one daughter and three grandchildren.Bev

Q49: Josh purchases a personal residence for $278,000

Q65: To be considered a Section 1202 gain,the