Multiple Choice

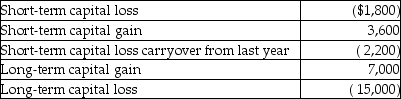

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

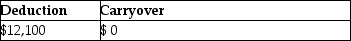

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

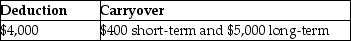

A)

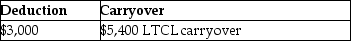

B)

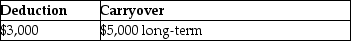

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q33: On January 1 of this year,Brad purchased

Q43: Monte inherited 1,000 shares of Corporation Zero

Q54: If the stock received as a nontaxable

Q70: Kate subdivides land held as an investment

Q71: Terrell and Michelle are married and living

Q102: Gains and losses are recognized when property

Q109: Jade is a single taxpayer in the

Q112: Coretta sold the following securities during 2016:

Q116: Dustin purchased 50 shares of Short Corporation

Q119: Topaz Corporation had the following income and