Essay

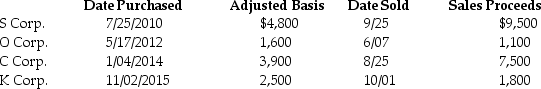

Mike sold the following shares of stock in 2016:

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

What are the tax consequences of these transactions,assuming his marginal tax rate is (a)33% and (b)39.6%? Ignore the medicare tax on net investment income.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: For purposes of calculating depreciation,property converted from

Q14: Taj Corporation has started construction of a

Q42: Brad owns 100 shares of AAA Corporation

Q57: Generally,gains resulting from the sale of collectibles

Q66: Sergio acquires a $100,000 Ternco Corporation bond

Q67: If an indivdual taxpayer's net long-term capital

Q70: Renee is single and has taxable income

Q75: Jack exchanged land with an adjusted basis

Q90: In a common law state,jointly owned property

Q128: Normally,a security dealer reports ordinary income on