Essay

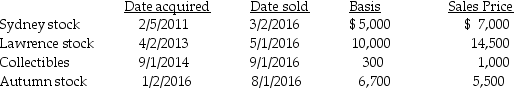

Chen had the following capital asset transactions during 2016:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

Correct Answer:

Verified

Long-term

Short-te...

Short-te...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: On January 31 of this year,Mallory pays

Q41: Douglas and Julie are a married couple

Q45: During the current year,Don's aunt Natalie gave

Q56: Will exchanges a building with a basis

Q59: A building used in a trade or

Q77: In a basket purchase,the total cost is

Q103: Rita died on January 1,2016 owning an

Q105: If a capital asset held for one

Q112: Coretta sold the following securities during 2016:

Q135: Corporate taxpayers may offset capital losses only