Multiple Choice

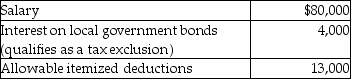

A single taxpayer provided the following information for 2016:  What is taxable income?

What is taxable income?

A) $58,950

B) $62,950

C) $66,950

D) $67,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Kelly is age 23 and a full-time

Q95: The child credit is for taxpayers with

Q96: Mr.and Mrs.Kusra are in the top tax

Q130: Ray is starting a new business and

Q141: Mia is a single taxpayer with projected

Q142: Bill and Tessa have two children whom

Q144: In October 2016,Joy and Paul separated and

Q145: Lewis,who is single,is claimed as a dependent

Q146: Rena and Ronald,a married couple,each earn a

Q148: John supports Kevin,his cousin,who lived with him