Essay

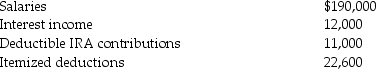

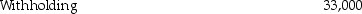

The following information is available for Bob and Brenda Horton,a married couple filing a joint return,for 2016.Both Bob and Brenda are age 32 and have no dependents.

a.What is the amount of their gross income?

a.What is the amount of their gross income?

b.What is the amount of their adjusted gross income?

c.What is the amount of their taxable income?

d.What is the amount of their tax liability (gross tax)?

e.What is the amount of their tax due or (refund due)?

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A building used in a business is

Q31: Generally,deductions for (not from)adjusted gross income are

Q67: Form 4868,a six-month extension of time to

Q93: Gina Lewis,age 12,is claimed as a dependent

Q94: In 2016,the standard deduction for a married

Q96: Cheryl is claimed as a dependent on

Q99: Brett,a single taxpayer with no dependents,earns salary

Q100: Julia provides more than 50 percent of

Q102: Kate is single and a homeowner.In 2016,she

Q103: Paul and Sally file a joint return