Essay

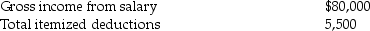

Steve Greene,age 66,is divorced with no dependents.In 2016 Steve had income and expenses as follows:

Compute Steve's taxable income for 2016.Show all calculations.

Compute Steve's taxable income for 2016.Show all calculations.

Correct Answer:

Verified

The additional stan...

The additional stan...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: Dave,age 59 and divorced,is the sole support

Q5: Rob is a taxpayer in the top

Q13: Kelly is age 23 and a full-time

Q17: For purposes of the dependency exemption,a qualifying

Q77: Generally,itemized deductions are personal expenses specifically allowed

Q79: Nonrefundable tax credits are allowed to reduce

Q95: The child credit is for taxpayers with

Q133: Vincent,age 12,is a dependent of his parents.During

Q136: For 2016,unearned income in excess of $2,100

Q149: The regular standard deduction is available to