Essay

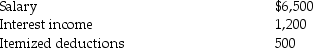

The following information for 2015 relates to Emma Grace,a single taxpayer,age 18:

a.Compute Emma Grace's taxable income assuming she is self-supporting.

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Silver Inc.is an S corporation.This year it

Q28: The standard deduction may not be claimed

Q51: A child credit is a partially refundable

Q90: Parents must provide more than half the

Q108: Elise,age 20,is a full-time college student with

Q109: For each of the following independent cases,indicate

Q113: Blaine Greer lives alone.His support comes from

Q116: Kadeisha is single with no dependents and

Q145: Amanda has two dependent children,ages 10 and

Q1519: When two or more people qualify to