Multiple Choice

Sandy and Larry each have a 50% interest in SL Partnership.The partnership and the individuals file on a calendar year basis.In 2015,SL Partnership had a $30,000 ordinary loss.Sandy's adjusted basis in her partnership interest on January 1,2015 was $12,000.In 2016,SL Partnership had ordinary income of $20,000.Assuming there were no other adjustments to Sandy's basis in the partnership,what amount of partnership income (loss) would Sandy show on her 2015 and 2016 individual income tax returns?

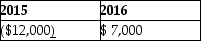

A)

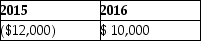

B)

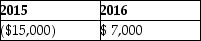

C)

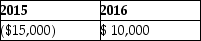

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q36: S status can be elected if 50%

Q48: An S corporation recognizes gain or loss

Q55: All of the following statements are true

Q57: Under the "check-the-box" Treasury Regulations,an LLC with

Q79: Marlena contributes property having a $30,000 FMV

Q108: Lars has a basis in his partnership

Q117: David and Joycelyn form an equal partnership

Q119: Jamahl has a 65% interest in a

Q1003: Discuss whether a C corporation, a partnership,

Q1172: Discuss the concept of partnership guaranteed payments.