Multiple Choice

Atiqa receives a nonliquidating distribution of land from her partnership.The partnership purchased the land five years ago for $20,000.At the time of the distribution,it is worth $28,000.Prior to the distribution,Atiqa's basis in her partnership interest is $37,000.Atiqa's basis in the distributed land and her post-distribution basis in her partnership interest are:

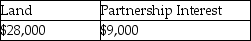

A)

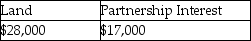

B)

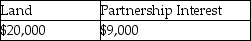

C)

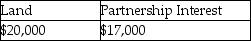

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q13: A partnership sells equipment and recognizes depreciation

Q33: A partnership is generally required to use

Q68: If a partner contributes depreciable property to

Q90: A partnership's liabilities have increased by year-end.As

Q96: The AAA Partnership makes an election to

Q99: Hal transferred land having a $160,000 FMV

Q101: An accounting partnership can become an electing

Q128: When an S corporation shareholder sells her

Q140: The basis of a partner's interest in

Q1746: What is the primary purpose of Form