Multiple Choice

To help retain its talented workforce,Zapper Corporation opens a child care facility in the building next to its offices.It spends $200,000 on rent,salaries and supplies.With respect to the $200,000 expenditure,Zapper will be entitled to a tax credit and a tax deduction of

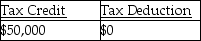

A)

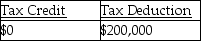

B)

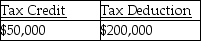

C)

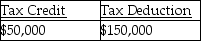

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Shafiq,age 16,works part-time at the local supermarket

Q40: The child and dependent care credit is

Q44: Suzanne,a single taxpayer,has the following tax information

Q56: Drake and Davina are married and file

Q58: Medical expenses in excess of 10% of

Q75: To claim the Lifetime Learning Credit,a student

Q78: Doggie Rx Inc.is a new company developing

Q93: Joe,who is single with modified AGI of

Q108: Margo and Jonah have two children,ages 13

Q908: Discuss tax- planning options available for expenses