Essay

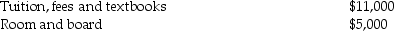

Tom and Anita are married,file a joint return with an AGI of $165,000,and have one dependent child,Tim,who is a first-time freshman in college.The following expenses are incurred and paid in 2016:

What is the maximum education credit allowed to Tom and Anita?

What is the maximum education credit allowed to Tom and Anita?

Correct Answer:

Verified

Tim is eligible for the American Opportu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: The alternative minimum tax applies to individuals

Q25: A couple has filed a joint tax

Q37: If an individual is liable for self-employment

Q76: A taxpayer's tentative minimum tax exceeds his

Q88: Evan and Barbara incurred qualified adoption expenses

Q89: Jorge has $150,000 net earnings from a

Q92: All of the following statements regarding self-employment

Q93: In 2016 Rita is divorced with one

Q99: Casualty and theft losses in excess of

Q2232: Discuss actions a taxpayer can take if