Essay

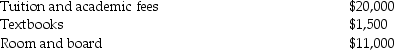

Burton and Kay are married,file a joint return with an AGI of $115,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2016:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Correct Answer:

Verified

Tyler is eligible for the Lifetime Learn...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Sam and Megan are married with two

Q28: Carlotta,Inc. ,has $50,000 foreign-source income and $150,000

Q29: During the year,Jim incurs $500,000 of rehabilitation

Q59: A taxpayer at risk for AMT should

Q60: Bud and Stella are married,file a joint

Q74: Business energy tax credits are available to

Q105: A taxpayer will be ineligible for the

Q107: Which of the following expenditures will qualify

Q107: Jake and Christina are married and file

Q246: Nick and Nicole are both 68 years