Multiple Choice

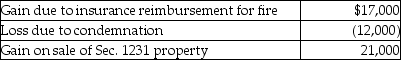

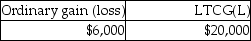

This year Pranav had the gains and losses noted below on property,plant and equipment used in his business.Each asset had been held longer than one year.  A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

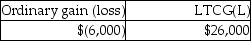

A)

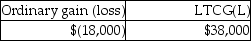

B)

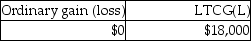

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Gifts of appreciated depreciable property may trigger

Q25: Ross purchased a building in 1985,which he

Q26: A building used in a business for

Q26: Terry has sold equipment used in her

Q31: Cassie owns equipment ($45,000 basis and $30,000

Q34: A net Sec.1231 gain is treated as

Q36: During the current year,Kayla recognizes a $40,000

Q82: Sec.1245 ordinary income recapture can apply to

Q92: Gains and losses resulting from condemnations of

Q1719: What is the purpose of Sec. 1245