Essay

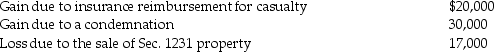

The following are gains and losses recognized in 2016 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

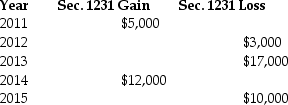

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Correct Answer:

Verified

The $20,000 gain from the casualty is tr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Connors Corporation sold a warehouse during the

Q37: During the current year,Hugo sells equipment for

Q46: A taxpayer purchased a factory building in

Q53: A taxpayer has a gain on Sec.1245

Q61: Douglas bought office furniture two years and

Q77: The purpose of Sec.1245 is to eliminate

Q98: Jillian,whose tax rate is 39.6%,had the following

Q100: For livestock to be considered Section 1231

Q101: Harry owns equipment ($50,000 basis and $38,000

Q101: Jeremy has $18,000 of Section 1231 gains