Essay

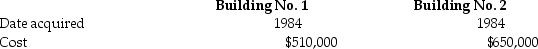

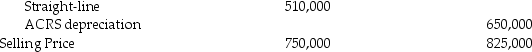

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for Building No.1 and the accelerated method (ACRS)was used for Building No.2.Information about those buildings is presented below.

Accum.Depreciation

Accum.Depreciation

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

How much gain from these sales should be reported as section 1231 gain and ordinary income due to depreciation recapture?

Correct Answer:

Verified

Building No.2 is con...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Aamir has $25,000 of net Sec.1231 gains

Q9: The following gains and losses pertain to

Q12: Pam owns a building used in her

Q16: Trena LLC,a tax partnership owned equally by

Q33: If realized gain from disposition of business

Q41: Gain due to depreciation recapture is included

Q81: For a business,Sec.1231 property does not include<br>A)timber,coal,or

Q84: When a donee disposes of appreciated gift

Q86: Jed sells an office building during the

Q93: Sec.1245 applies to gains on the sale