Multiple Choice

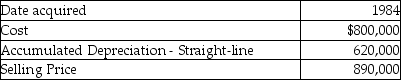

A corporation sold a warehouse during the current year.The straight-line depreciation method was used.Information about the building is presented below:  How much gain should the corporation report as section 1231 gain?

How much gain should the corporation report as section 1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Frisco Inc.,a C corporation,placed a building in

Q11: Alejandro purchased a building in 1985,which he

Q24: Emma owns a small building ($120,000 basis

Q27: When appreciated property is transferred at death,the

Q69: Jaiyoun sells Sec.1231 property this year,resulting in

Q83: Dinah owned land with a FMV of

Q86: Pierce has a $16,000 Section 1231 loss,a

Q91: During the current year,George recognizes a $30,000

Q97: Why did Congress establish favorable treatment for

Q109: Hilton,a single taxpayer in the 28% marginal