Multiple Choice

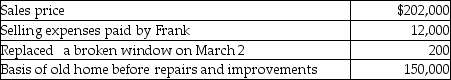

Frank,a single person age 52,sold his home this year.He had lived in the house for 10 years. He signed a contract on March 4 to sell his home and closed the sale on May 3. Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q23: If a principal residence is sold before

Q26: If the taxpayer elects to defer the

Q40: The holding period of like-kind property received

Q49: Which of the following statements is false

Q50: Indicate with a "yes" or a "no"

Q67: Eric exchanges a printing press with an

Q74: A owns a ranch in Wyoming,which B

Q90: The building used in Manuel's business was

Q477: Discuss the rules regarding the holding period

Q849: May a taxpayer elect under Sec. 1033