Multiple Choice

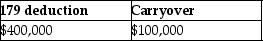

Caitlyn purchases and places in service property costing $450,000 in 2016.She wants to elect the maximum Sec.179 deduction allowed.The property does not qualify for bonus depreciation.Her business income is $400,000.What is the amount of her allowable Sec.179 deduction and carryover,if any?

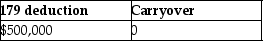

A)

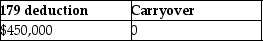

B)

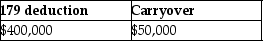

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q19: If the business use of listed property

Q22: For real property placed in service after

Q34: Sec.179 tax benefits are recaptured if at

Q38: In accounting for research and experimental expenditures,all

Q58: If the business use of listed property

Q67: On January 1,2016,Charlie Corporation acquires all of

Q70: In August 2016,Tianshu acquires and places into

Q70: Intangible drilling and development costs (IDCs)may be

Q71: Enrico is a self-employed electrician.In May of

Q74: Terra Corporation,a calendar-year taxpayer,purchases and places into