Essay

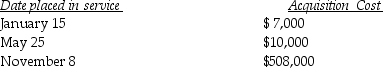

Greta,a calendar-year taxpayer,acquires 5-year tangible personal property in 2016 and places the property in service on the following schedule:

Greta elects to expense the maximum under Sec.179,and selects the property placed into service on November 8.The property is not eligible for bonus depreciation.Her business 's taxable income before Sec.179 is $790,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2016?

Greta elects to expense the maximum under Sec.179,and selects the property placed into service on November 8.The property is not eligible for bonus depreciation.Her business 's taxable income before Sec.179 is $790,000.What is the total cost recovery deduction (depreciation and Sec.179)for 2016?

Correct Answer:

Verified

Because Sec.179 expensing is ...

Because Sec.179 expensing is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Intangible assets are subject to MACRS depreciation.

Q32: Residential rental property is defined as property

Q37: In computing MACRS depreciation in the year

Q38: Land,buildings,equipment,and common stock are examples of tangible

Q50: Under the MACRS system,automobiles and computers are

Q54: Amounts paid in connection with the acquisition

Q63: Jimmy acquires an oil and gas property

Q73: Galaxy Corporation purchases specialty software from a

Q88: The MACRS system requires that residential real

Q89: Chahana acquired and placed in service $665,000