Multiple Choice

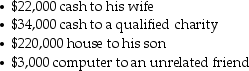

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

The total of Paul's taxable gifts,assuming he does not elect gift splitting with his spouse,subject to the unified transfer tax is

A) $206,000.

B) $214,000.

C) $234,000.

D) $279,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Which of the following taxes is regressive?<br>A)Federal

Q9: Eric dies in the current year and

Q23: The IRS must pay interest on<br>A)all tax

Q26: Which of the following taxes is progressive?<br>A)sales

Q32: Sarah contributes $25,000 to a church.Sarah's marginal

Q89: Which of the following taxes is proportional?<br>A)gift

Q95: Which of the following statements is incorrect?<br>A)Property

Q108: Briana,who is single,has taxable income for the

Q421: Explain how returns are selected for audit.

Q967: A presidential candidate proposes replacing the income