Essay

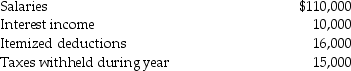

Brad and Angie had the following income and deductions during 2016:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

Tax = $10,357.50 + .25(95,900...

Tax = $10,357.50 + .25(95,900...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q4: A progressive tax rate structure is one

Q20: Gifts made during a taxpayer's lifetime may

Q33: Alan files his 2016 tax return on

Q37: Latashia reports $100,000 of gross income on

Q44: While federal and state income taxes,as well

Q55: The primary liability for payment of the

Q57: Limited liability companies may elect to be

Q61: The marginal tax rate is useful in

Q93: Which of the following is not one

Q586: List the steps in the legislative process