Multiple Choice

What are the correct monthly rates for calculating failure to file and failure to pay penalties?

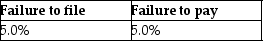

A)

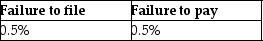

B)

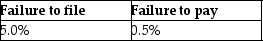

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Jeffery died in 2016 leaving a $16,000,000

Q4: Denzel earns $130,000 in 2016 through his

Q9: The term "tax law" includes<br>A)Internal Revenue Code.<br>B)Treasury

Q10: In 2016,an estate is not taxable unless

Q12: Firefly Corporation is a C corporation.Freya owns

Q50: Which of the following is not a

Q66: Which is not a component of tax

Q70: Property transferred to the decedent's spouse is

Q80: All states impose a state income tax

Q91: Generally,tax legislation is introduced first in the