Essay

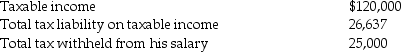

Frederick failed to file his 2016 tax return on a timely basis.In fact,he filed his 2016 income tax return on October 31,2017, (the due date was April 15,2017 and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2016 return:

Frederick sent a check for $1,637 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2016.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,637 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2016.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Correct Answer:

Verified

Since Frederick's return is filed late a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: The largest source of revenues for the

Q20: Gifts made during a taxpayer's lifetime may

Q22: Jillian,a single individual,earns $230,000 in 2016 through

Q23: Chris,a single taxpayer,had the following income and

Q45: The computer is the primary tool of

Q52: The Sixteenth Amendment to the U.S.Constitution permits

Q57: Limited liability companies may elect to be

Q93: Which of the following is not one

Q94: Larry and Ally are married and file

Q586: List the steps in the legislative process