Multiple Choice

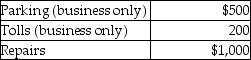

Brittany,who is an employee,drove her automobile a total of 20,000 business miles in 2014.This represents about 75% of the auto's use.She has receipts as follows:  Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

Brittany's AGI for the year of $50,000,and her employer does not provide any reimbursement.She uses the standard mileage rate method.After application of any relevant floors or other limitations,Brittany can deduct

A) $11,200.

B) $12,200.

C) $11,950.

D) $13,200.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In determining whether travel expenses are deductible,a

Q6: Characteristics of profit-sharing plans include all of

Q33: Tessa is a self-employed CPA whose 2015

Q34: Clarissa is a very successful real estate

Q36: Bill obtained a new job in Boston.He

Q37: Donald takes a new job and moves

Q40: Chelsea,who is self-employed,drove her automobile a total

Q42: Travel expenses for a taxpayer's spouse are

Q150: Travel expenses related to foreign conventions are

Q1370: Commuting to and from a job location