Multiple Choice

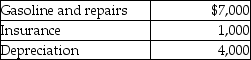

Jordan,an employee,drove his auto 20,000 miles this year,15,000 to meetings with clients and 5,000 for commuting and personal use.The cost of operating the auto for the year was as follows:  Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

Jordan submitted appropriate reports to his employer,and the employer paid a reimbursement of $ .50 per mile.Jordan has used the actual cost method in the past.Jordan's AGI is $50,000.What is Jordan's deduction for the use of the auto after application of all relevant limitations?

A) $1,500

B) $500

C) $1,000

D) $8,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: All of the following are true with

Q19: Which of the following conditions would generally

Q32: Jack takes a $7,000 distribution from his

Q39: Wilson Corporation granted an incentive stock option

Q56: West's adjusted gross income was $90,000.During the

Q59: A sole proprietor establishes a Keogh plan.The

Q66: Martin Corporation granted an incentive stock option

Q103: Chuck, who is self- employed, is scheduled

Q134: The maximum tax deductible contribution to a

Q190: Why did Congress establish Health Savings Accounts